Abertis ends 2024 with EUR 6,072 million of revenue and its EBITDA rises 10.2% to EUR 4,292 million

•Revenues grew 9.8%, driven by 1.5% global traffic growth, an expanded perimeter and tariff upgrades in the different markets while EBITDA improved by 10.2%.

•Throughout the year, Abertis successfully integrated the assets acquired in the previous year in Puerto Rico and Spain at the start of 2024, and won a new concession in Chile, demonstrating its capacity to continue growing, maintaining a balanced portfolio and bringing stability to the Group.

•In 2024, the Group achieved a significant debt reduction of EUR 3,300 million, thanks to strong cash generation and optimisation of its financial structure, as well as a EUR 1.3 billion shareholder contribution in February 2024.

•The Abertis Board of Directors has today called the Annual General Meeting to be held on 31 March, which includes a proposed distribution to shareholders of EUR 602 million.

27th February 2025.- Abertis today published its annual results for the 2024 financial year, confirming significant growth in the Group's main financial and operational indicators.

Positive global traffic development

The overall traffic trend on the motorways run by Abertis remained positive in 2024 to reach a daily average of 25,837 vehicles, an increase of 1.5% over the previous year. In this line, light vehicle traffic increased by 1% compared to 2023, while heavy vehicles showed solid growth with 3.4%.

Income statement

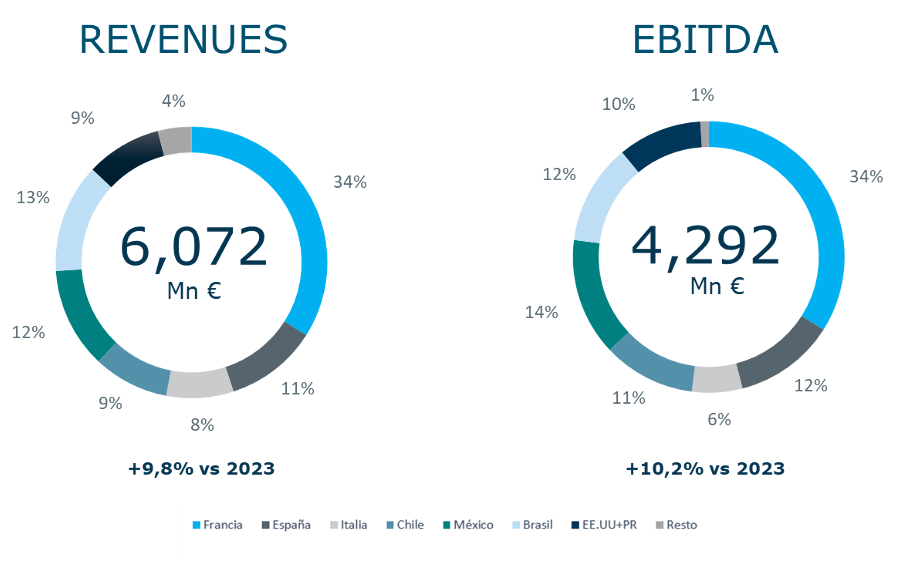

Abertis' revenues in 2024 totalled EUR 6,072 million, representing an increase of 9.8% compared to 2023, while EBITDA increased by 10.2% to EUR 4,292 million.

Abertis maintains a good and balanced portfolio, in which more than 60% of EBITDA comes from Europe and North America, in euros and dollars, respectively. France remains the country with the largest contribution, with 34%, followed by Mexico (14%), Spain (12%), Brazil (12%), Chile (11%) and Italy (6%). Business in North America (Virginia and Puerto Rico) again performed very well with a 10% contribution to EBITDA

New concessions and operations

In 2024, Abertis successfully integrated concessions in Puerto Rico and Spain, a key step in consolidating the company's new perimeter and ensuring that the new toll roads operate in line with Abertis' high standards of safety, quality and sustainability

Abertis also expanded its presence in Chile after winning the tender for the Ruta 5 Santiago - Los Vilos road, contributing to the company's growth and cash flow replacement strategy, and maintaining a balanced portfolio that brings stability to the Group. This new concession bolsters Abertis' position in the Chilean market, where it already manages more than 400 kilometres, and will be operated by its subsidiary VíasChile from April 2025.

The year also saw Abertis closing its acquisition of the Autovía del Camino (Navarra) and raising its controlling stake in the Trados 45 concession (Madrid) to 100%.

In August, Arteris, an Abertis subsidiary in Brazil, inaugurated the Contorno Viario de Florianópolis, a 50-kilometre-long motorway with four tunnels equipped with advanced safety systems, which is now reducing congestion and travel times and enhancing road safety for all users in the region.

Also in Brazil, the concessionaire Intervias signed a deal granting it a 12-year extension to keep on operating a 380-kilometre highway in the state of São Paulo until 31 December 2039. The extension will call for additional investments to maintain service levels, special maintenance of the pavement, acquisition of equipment, vehicles and systems.

Between June and December 2024 Sanef, Abertis' French subsidiary, launched a groundbreaking technology upgrade project by commissioning free-flow tolls on the A-13 and A-14 motorways linking Paris to the Normandy region. The 210 kilometres of free-flow motorways have radically transformed equipment, processes and operations, allowing users to travel on even safer roads, saving time and fuel.

Investments

Abertis invested EUR 718 million in 2024, mainly in the improvements in Brazil (Florianópolis Beltway) and France (commissioning the free-flow system on the A-13 and A-14), and in the Ramales project in Mexico. These investments ensure infrastructure maintenance and operation excellence, one of the Group's strategic pillars in each and every country in which it operates. Abertis strives to continuously improve motorways, guaranteeing more sustainable roads with high levels of user safety and comfort.

Financial management and balance sheet

During the year, the Group paid off bank debt, optimising the use of available cash while improving its debt maturity profile and reducing its interest rate fluctuation exposure.

Net debt at year-end stood at EUR 22,585 million, EUR 3,300 million less than at year-end 2023, a significant reduction attained through both solid cash generation and the February 2024 EUR 1.3 billion contribution from its shareholders, ACS Group and Mundys, designed to boost Abertis' balance sheet following the growth operations completed in 2023. Most of the debt is at a fixed rate (88%), while the Group's liquidity exceeds EUR 8,316 million, between available cash and liquidity lines.

In October 2024, the Texas Department of Transportation exercised the termination for convenience clause included in the SH-288 concession agreement in exchange for a compensatory payment of USD 1.732 billion. The Group used these funds to repay $650 million of existing debt on SH-288 and EUR 700 million of debt raised for the Abertis Infraestructuras acquisition, which enabled the Group to reduce debt by around EUR 1.2 billion in the last quarter of the year. This early termination was neutral of credit rating terms.

In November, Abertis Infraestructuras successfully placed a €750 million hybrid bond issue through Abertis Finance B.V., a subordinated perpetual bond with a first repurchase option window at 5.25 years and which for accounting purposes is considered part of the Group's consolidated equity. The successful placement among qualified investors, with a demand of 3.6x the subscribed capital, enabled the issue to close with a fixed coupon of 4.8%. The funds received were used to repay EUR 749 million of the EUR 1.25 billion hybrid bond issue placed in November 2020.

Healthy performance by Abertis Mobility

Abertis Mobility Services (AMS) ended 2024 with new contracts that are set to boost its volume of business in the coming months. AMS operates in different markets under the commercial brand Emovis and has performed well in rolling out platforms with cutting-edge technology and operation services for smart mobility in urban and interurban environments.

In the US, CTIO (Colorado Transportation Investment Office), a Colorado Department of Transportation (CDOT) agency, awarded Emovis the tender to roll out its back-office systems and operate its managed lane billing process.This will involve Emovis implementing the systems and running the platforms and user service processes of a significant part of the Colorado state highway network.

The end of 2024 saw Emovis fully engaged in rolling out the processes and resources for its project for FTE (Florida's Turnpike Enterprise), to operate FTE's customer service channels by 2025, facilitating toll payment for users of the road network run by Sunpass FTE. Also on the US market, the company also began work on overhauling the free-flow toll system of its client RITBA (Rhode Island Turnpike and Bridge Authority).

Emovis grew in Europe when Mont Blanc Motorways and Tunnel (ATMB) awarded it the tender to deploy the free-flow toll system on the 58-km stretch of the A40 motorway between Sallanches and Annemasse in France. Scheduled to be operational in 2027, the system will offer a safer driving experience with more optimised journey times.

In 2024, Emovis also launched the first free-flow tolling project in the Netherlands, on the A24 motorway in the Rotterdam area, enabling more than 50,000 vehicles per day to cut their journey time from 12 to 3 minutes, thanks to this new road management scheme.

Closing the ESG Plan 2022-2024

In 2024, Abertis closed the first ESG Plan included in its Sustainability Strategy for the period 2022-24 with significant achievements in decarbonisation, energy efficiency, safety and good governance.

In decarbonisation terms, in 2024 the Group reduced its Scope 1 and 2 emissions to 57,582 tonnes, or 8.9% less than the previous year. The Group achieved this goal by backing energy efficiency-related schemes such as boosting self-generation energy, increasing the fleet of alternative fuel vehicles, and investing significantly in installing electric vehicle charging points, 776 by the end of 2024. The amount of recycled materials used in maintenance operations rose 16% in 2024, the main contributor being increased use of recycled granulate, primarily for the expansion works carried out in Brazil in the Florianópolis project; and the recycling of non-hazardous waste jumped 86% in 2024, driven by the achievement of the ISO 14001 environmental management system certification, which guarantees the systematisation of environmental aspects in an organisation.

In road safety, the IF3 fatality rate fell 4% compared to 2023, especially in Mexico and India where it dropped 15% and 17% respectively, and with all other business units reporting markedly positive trends, as all of them made significant efforts throughout 2024 to cut the total number of fatalities.

As for governance, the Group improved its workforce's gender balance in 2024, and now 32.5% of management positions are held by women.

Abertis also formally approved its new ESG Plan 2025-27 last year, outlining its clear roadmap for rolling out schemes and projects aligned with the Sustainability strategy 2022-2030, with a high degree of engagement of both corporate functional areas and all business units.

Outlook for 2025

Abertis' outlook for 2025 is to consolidate its position as a benchmark operator in the countries in which it is present, and it expects and hopes to participate and grow with new projects, as well as in extensions of existing concessions in exchange for new investments.

Further challenges include maintaining a sound financial structure and continuing to minimise exposure to financial risks, pending market developments and related geopolitical movements.

Board of Directors' Resolutions

The Abertis Board of Directors has called the Ordinary General Shareholders' Meeting, to be held next 31 March. Items on the agenda are to include the proposal to distribute EUR 602 million to its shareholders.

The agenda also features the approval of the individual and consolidated annual accounts and their respective management reports for financial year 2024.

Share

Related news

Abertis reinforces its leadership and reaches 100% of the Vallvidrera and Cadí tunnels in Catalonia

11 December 2025

•The Group, who already controlled 50.01% through its subsidiary Autopistas, completes the acquisition of the company that operates those tunnels.

Abertis reaches an agreement to acquire a majority stake in the French A-63 highway, a strategic corridor between Spain and Northern Europe

28 February 2025

•El Grupo, participado por el Grupo ACS y Mundys, adquiere una participación del 51,2% del activo, que gestiona una autopista de peaje de 104 kilómetros en el suroeste de Francia, reforzando su posición en un mercado clave.

•La A-63 es un corredor estratégico entre España y el norte de Europa que sirve de enlace entre Burdeos y las localidades de Bayona, Biarritz, Anglet y San Juan de Luz, formando una importante área turística próxima a la frontera española.