ANNUAL RESULTS 2023 -Abertis grows its revenues and EBITDA in a new growth phase

•Revenues increased by 8.4% to 5,532 million euros, driven by 3,4% global traffic growth and tariff updates in the different markets.

•EBITDA ended 10.1% higher at EUR 3,893 million, boosted by efficient business management.

•The Group disbursed EUR 4,959 million, allocating around EUR 4,000 million to new acquisitions with concession terms of more than 40 years, and the remainder to road maintenance and upgrades, mainly in Brazil, France and Mexico.

•Abertis reinforced its global leadership in transport infrastructure management with new concessions in Houston (Texas) -the managed line SH-288-, four new motorways in Puerto Rico and the Autovía del Camino in Spain, with its shareholders' support.

•The Abertis Board of Directors, renewed last January, has today called the General Meeting to be held on 9 April, which includes a proposed distribution to shareholders of EUR 602 million euros.

28 February 2024.- Abertis today published its annual results for the 2023 financial year, which show significant growth in overall traffic, as well as in the main financial figures.

The Group ended the year with traffic 3.4% higher than in 2022, representing robust growth in the main markets in which it operates, in particular countries such as the United States, France, Brazil and Mexico, where traffic is growing steadily. In line with previous years' trend, light vehicle traffic increased the most, 3.9% compared to 2022, while heavy vehicle traffic grew by 1.7%, on a like-for-like basis.

Income statement

Abertis closed the year with revenues of EUR 5,532 million, 8.4% more than in 2022, driven by higher volumes of traffic and tariff hikes in the main markets, which boosted the year's results. The Group's EBITDA amounted to EUR 3,893 million, 10.1% up on 2022.

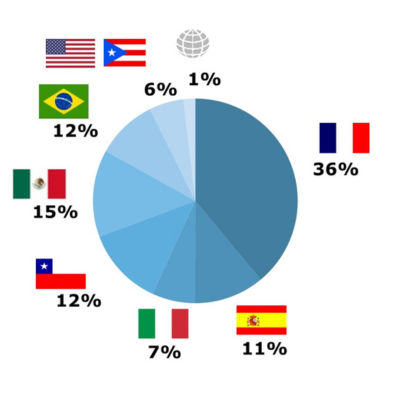

As in 2023, most of the Group's EBITDA came from Europe, which accounted for 54%, and France again contributed the biggest amount, 36%. The North American business (Virginia and Puerto Rico) put on an excellent performance by contributing 6%-plus of EBITDA, and is set to gain more weight in the business this year when it includes the new concessions in Texas and Puerto Rico. Overall, Abertis' portfolio remains balanced and healthy, with Europe and North America accounting for in 60%-plus of EBITDA.

EBITDA 2023

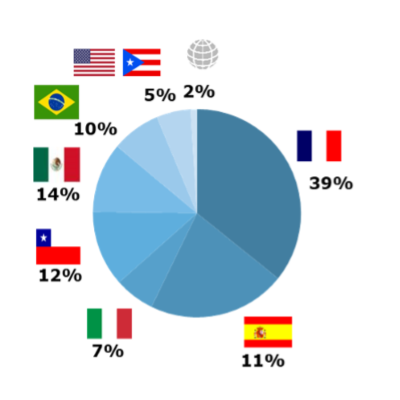

EBITDA 2022

Investments

Abertis has invested EUR 4,959 million, having allocated EUR 4,063 million to its new acquisitions in the United States and Puerto Rico. Aside from their long concession life (40 years in Puerto Rico and 45 years in the case of SH-288 in Texas), they are set to bolster a market in which the Group already has a consolidated foothold.

The other investments were allocated to road maintenance and improvements, mainly in Brazil, France and Mexico. All these investments ensure road maintenance excellence, one of the Group's strategic pillars in all the countries where it operates. Abertis is committed to continuously upgrading motorways, guaranteeing more sustainable roads with excellent levels of safety and comfort.

Expansion operations

In 2023, Abertis announced it was acquiring new concessions in the United States, Puerto Rico and Spain, although it completed its acquisition of the Autovía del Camino in Navarra in 2024, after obtaining the appropriate regulatory authorisations. These operations are another plank of the Group's growth and cash flow replacement strategy, and once again spotlight both the financial flexibility and quality of its efficient and sustainable asset management, and its capacity to keep on extending the average concession life of its assets.

Adding these assets to its portfolio boosts Abertis' exposure to markets with a stable legal framework and with a strong dollar-euro type currency mix.

Abertis has financed these new toll roads with bank debt, available cash and a capital contribution of EUR 1.3 billion recently provided by the company's shareholders, ACS Group and Mundys Group, as a result of their commitment to strengthen the Group's global leadership in transport infrastructure concessions; a capital contribution designed to support the financing of these operations while strengthening the balance sheet and the current credit rating.

The assets and debt of the new acquisitions were consolidated in 2023, while their financial figures will be included from 2024 onwards.

On another note, in January 2024, Arteris in Brazil reached an agreement with the São Paulo state authorities to extend the concession period of Intervías for a further 10 years, until 2039. This agreement also resolves issues related to existing credits and debts, and allows Arteris to keep on investing in the country with an updated legal framework.

Financial management and balance sheet

During 2023, the company once again demonstrated its strength in accessing markets on attractive terms. Abertis always targets to further extend the average life of its debt, optimise financial costs and minimise interest rate risk exposure. In January 2023, Abertis successfully placed a EUR 500 million 7-year bond issue of its French subsidiary HIT, while in June it successfully placed another EUR 500 million bond issue in the international institutional market, which was used to refinance existing debt maturities and strengthen the company's liquidity position.

In addition, in January 2023 Abertis became one of its industry's first companies to successfully complete a Sustainability-Linked Bonds transaction linked to the fulfilment of its sustainability strategy for a total of EUR 600 million.

Net debt at year-end stood at EUR 25,875 million, slightly higher than in 2022 due to the growth operations announced in 2023. Most of the debt is at a fixed rate (74%), while the Group's liquidity exceeds EUR 8,144 million, which rises to 9,444 million euros including the capital contribution paid in February 2024, covering debt maturities for more than 2 years.

New Abertis Mobility Services projects

Abertis Mobility Services (AMS) is Abertis' technological competence centre, which specialises in rolling out cutting-edge technology platforms and operation services to foster smart mobility in urban and interurban environments. This subsidiary ended 2023 with new contracts that will boost its activity and strengthen its structure over the coming years, especially in the American market.

The new projects feature a deal between AMS - through Emovis, its US commercial brand - and the Florida Turnpike Enterprise (FTE) authority to provide customer service operations to the more than 10 million electronic tolling users on Florida's highways. AMS remains committed to rolling out road usage charging-based projects, such as the pilot project launched in Oklahoma, and the launch of the IMMENSE project, in which it developed and tested a road usage charging solution in the Low Emission Zones of the cities of Munich (Germany) and Esplugues de Llobregat (Barcelona).

Sustainability Strategy

In 2023, Abertis continued to promote its sustainability strategy and the first ESG Plan for the period 2022-24. One of the ESG plan's main planks is decarbonisation, and its subsidiaries have made headway by installing solar panels to promote self-consumption, migrating towards fleets of less polluting vehicles, purchasing green energy, using more recycled maintenance materials, encouraging recycling and waste recovery, and bringing more environment-friendly construction materials into their life cycle. The Group now also has a much larger number of electric charging points (a total of 702), after launching charging point installation plans in France, Spain, Italy, Mexico and Chile.

Another of the year's highlights was the pilot project implemented in Brazil and France, designed to develop a biodiversity impact quantification methodology for practical application on motorways. The Group remains committed to using recycled, with a strategy that focuses on monitoring waste recovery, and plans to make further headway in implementing environmental management systems.

In 2023, Abertis had its greenhouse gas emission reduction targets validated by the Science Based Targets (SBT) initiative, which has used scientific criteria to confirm that they are on track with the Paris Agreement. Specifically, Abertis has committed to cut the tonnes of scope 1 and 2 CO2 25% by 2024 and 50% by 2030 (compared to 2019), and its scope 3 target is to cut it 10% by 2024 and 22% by 2030. In 2023, its scope 1 and 2 emissions for the year totalled 63,228 tonnes, 21.8% less than to the previous year.

Highlights for 2024

The Group's key goal for 2024 is to properly integrate the new assets acquired in the United States and Spain, ensuring that they start operating to Abertis standards in operational, safety, quality and sustainability terms, based on the infrastructure management experience it has gleaned around the world.

Abertis also aims to keep on growing through new asset acquisition opportunities, especially in traditional markets where the Group already has a foothold, with a special focus on mature markets such as North America, Europe or Australia, while maintaining a solid and optimised financial structure, with a long average debt life.

Board of Directors' Resolutions

The Abertis Board of Directors, which was enlarged and renewed on 30 January, has called the Ordinary General Shareholders' Meeting, to be held on 9 April. Items on the agenda are to include the proposal to distribute EUR 602 million to its shareholders.

The agenda also features the approval of the individual and consolidated annual accounts and their respective management reports for financial year 2023.